Lender of the last resort or good use of your assets

Author: Dennis Lennie

Published 1st June 2008

Recently several people have asked me why companies use factoring or invoice discounting as a way of dealing with debtors. “Are they in trouble?” and “Is it the last straw before throwing in the towel?” were the most common questions. So I thought I would talk you through these types of sales finance, dispelling a few myths by explaining when they are useful for business.

First let’s run through exactly what factoring and invoice discounting mean.

Both are types finance enabling a company to sell its debt – its sales ledger (hence the term sales finance) – to increase the cash available within the business.

For those in the finance business, factoring is synonymous with the 1970s and 1980s when it first emerged as a creative way of managing debt. During the recession of the early 1990s, factoring companies were blamed for the failure of many companies – whose shareholders and directors believed still had life in them – and gained the reputation of being lenders of last resort. Since then the sales finance industry has worked hard to clean up its act and reputation.

So how would factoring and invoice discounting work for your business?

The main difference between them is that invoice discounting, is confidential; factoring, is not.

With invoice discounting, your debtor never knows that the debt has been sold. An invoice discounting company will usually pay up to 70 per cent of the value of your sales ledger and will take a debenture over (in effect, owning) the whole of your company’s book debt and, in some cases, all your assets. It will run regular audits and charge you interest on the outstanding balance plus a monthly management charge. You continue to collect the debts and, when you receive payment, you pay it into a joint bank account. Clearly it is in your interests to continue to chase debts, to minimise the interest you pay on outstanding balances.

With factoring, you sell each debt immediately to a factoring house which then collects the money. Your customers will know you have sold the debt as the invoice will ask them to pay the factoring house. You do not have to chase any of the debt (saving you money on staff costs or time). Normally factoring houses, like invoice discounters, take a debenture and pay around 70 per cent of the invoice value; they usually only factor to a list of pre-agreed debtors, paying you less per invoice for weaker credits; they charge an interest rate on outstanding balances and a collection fee. They also normally chase their debts harder.

Co-incidentally banks today, after various high court rulings last year, prefer to lend on specific debt rather than have non-specific overdraft and loan debentures. They, too, offer factoring and invoice discounting – but their terms and conditions could be different so be aware of what’s available.

Why and when?

Why? First, as mentioned, a bank may not now offer or extend unlimited overdrafts or loans based on the strength of your assets. Until recently, if your balance sheet was worth, say, £500,000 in equity or reserves, a bank would lend loans and overdrafts of up to, say, £300,000 just on the strength of your balance sheet. Nowadays they would prefer to add a mix of debt that is specific and identifiable – a mortgage on a property, some asset finance on equipment, a small working overdraft and some sales finance – all secured under one debenture, probably topped up with a personal guarantee. Always be aware that banks cross-collaterise their debt so, if you owe money across several of their finance houses, you still owe one combined debt.

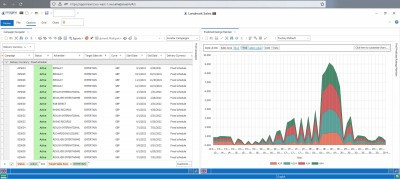

Secondly, and probably a better reason, it is useful for cash flow. Look at your business and see where the peaks and troughs in cash flow occur. Then look at what happens in a growth spurt: the busier you get the less cash you have. For example, you are a hire or post company. You become manically busy and have a record month – then you have to wait 30 or 60 days for the money to come in. In the meantime you have monthly payments to make – salaries, overtime, freelancers, PAYE and even, sometimes, the VAT – before you receive any of this money.

When? It is always wise never to be too reliant on one type of debt and, as I said in my previous article, it is best not to leave it too late to open up facilities. Sales finance is a useful tool for a growing business: you get your money early on completed sales. Yes, it involves a cost but it could be worth paying a small premium to have cash at this stage. For a business that is going the wrong way, don’t dismiss the idea. If you have a good list of debtors and no other options to raise money (you are at the top of your overdraft, all your assets are financed, you have the money to implement the necessary redundancies) but the business needs some cash then, yes, use those debtors to raise that cash.

Watch out!

There are, of course, some guidelines you must follow. Never – ever – mess an invoice discounter around. Their terms and conditions give them have huge rights and they are very protective of their positions. For example, if you put money into the wrong account (not the joint account) they can remove your facility overnight, asking for immediate repayment. If you can’t repay them they could, under their debenture rights, appoint an administrator and, effectively, put you into administration. This is tough stuff – and it’s how they earned their reputation in the 1990s. However today’s discounters are far more reasonable and, in my experience, will, if spoken to first, work with a company rather than take extreme action.

So, what is my conclusion? I suppose I am a man who says that a little of everything is better than a lot of something so, generally, I like to look at a company and evaluate where the risks are. Is there too much exposure to one type of debt? If the company were suddenly to double – or halve – in size, could its current facilities cope? And so on. Overall, I would set up a debt facility, have it available, but probably not use it until I had to. And, hopefully, that would only be during company growth.

I hope this has helped but, if you’d like to know more, do get in touch.

The series continues next month. If you have missed previous articles, or if you would like to comment on them by making comments on our blog, see: www.azule.co.uk/articles.asp